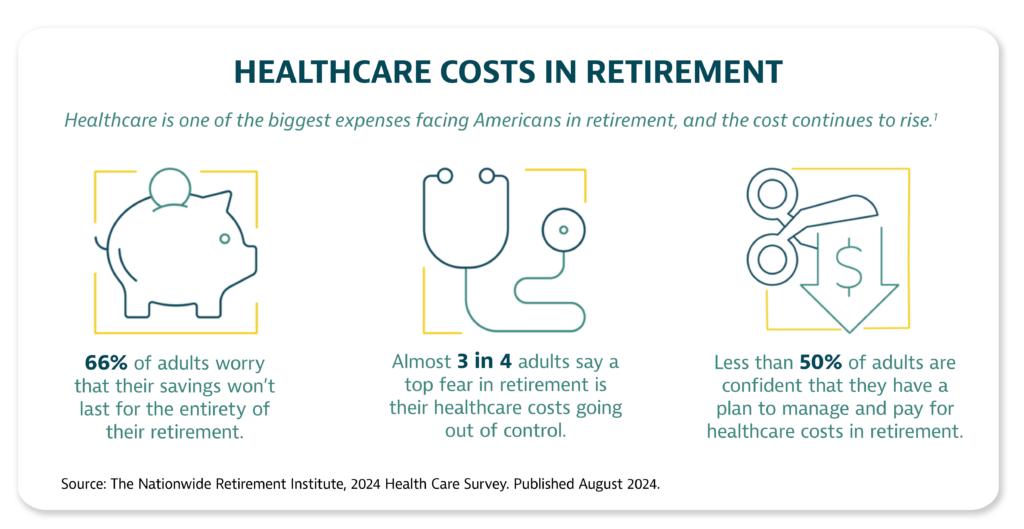

Could a cooperative continue to subsidize retiree health care benefits without disrupting its balance sheet or taking on outsized funding obligations?

The Challenge

One of America’s largest cooperatives, Nothern Virginia Electric Cooperative (NOVEC), has a well-deserved reputation for operational efficiency and innovation. In 1990, after the Financial Accounting Standards Board’s (FASB’s) approval of Statement 106, the cooperative realized it would have to either account for the expected future cost of retiree medical benefits or drop retirees from its group health plan altogether. After a long history of providing some health care assistance to retirees, eliminating coverage was not in keeping with NOVEC’s benefits philosophy.

The Partnership

Cooperative leadership reasoned that if they established a trust account, according to the guidance provided in FASB 106, and invested thoughtfully over time, the account could grow and meet their obligations. This would allow the co-op to continue helping employees cover their medical costs in retirement. Even in the ‘90s, Medicare didn’t cover everything, and now there are more restrictions, with many providers — especially in rural areas — declining to accept Medicare insurance. Thus, more of the cost burden has shifted to retirees.

Because NOVEC had previously worked with Homestead Advisers, it felt comfortable choosing Homestead Funds for account services and investment options.

“We have had a long-standing relationship with Homestead Funds as a member of NRECA, so it just seemed like a logical solution for us when setting up the trust.”

— Stan Feuerberg, Retired CEO, Northern Virginia Electric Cooperative

The Solution

NOVEC determined its funding obligation and set up a postretirement welfare plan trust. Once established, assets were invested in a mix of Homestead Funds with a goal of providing growth over the long term with an appropriate level of capital preservation.

Further, the cooperative determined that putting a cap on the amount it would agree to contribute to a retiree’s postretirement benefit would be a prudent way to limit its future funding obligations and reduce the risk that the costs would require large and unanticipated capital outlays.

- Today, Homestead Advisers continues to work with NOVEC by providing performance metrics and periodic check-ins to ensure the asset allocation continues to meet the co-op’s investment objectives.

- NRECA offers a range of administrative services to assist co-ops in account setup and management, including providing sample model plan documents, preparation of required regulatory reporting forms and actuarial valuations.

“We just thought the appropriate thing to do would be to have a set aside to cover these costs. And we figured if we did it right by investing a little bit at a time and letting it grow, the burden on the income statement wouldn’t be all that great.”

— Stan Feuerberg, Retired CEO, Northern Virginia Electric Cooperative

The Results

NOVEC’s retirees, who are mostly long-term employees, appreciate the support. As health care costs have gone up, the trend has been for organizations — including some cooperatives — to limit eligibility to current employees or reduce benefits. NOVEC is proud to have found a way to continue to offer post-retirement coverage to all employees.

The testimonial/endorsement set forth above was provided on behalf of a cooperative that is a member of the NRECA system. It is provided for illustrative and educational purposes only and may not be representative of the experience of others receiving similar services. It is not intended to suggest or guarantee that any client’s investment objectives or goals will be met.

Retiree Medical Plans (FAS-106)

Partner With Us